What is MOD Charges for Home Loan HDFC and SBI

Table of Content

Such a scenario may arise, if the seller backs out from the deal at the last minute. This could also happen if the buyer starts to have doubts about the builder from whom he is buying the unit. Legal fees are charged when banks opt external lawyer to validate the legal aspects of your home loan. If you have been offered a lesser amount than what you applied for, the excess processing fees collected would be refunded in most cases. If you default on payment then bank will charge entire cost of recovery i.e. Charges may vary from Rs 250/installment, some % of recovery amount or Actual recovery expenses incurred by bank if recovery is under SARFAESI ACT.

Document – Other than authorising an agent or others to sell, transfer, or develop the immovable property, a general power of attorney is used for any other reason. Banks charge a non-refundable fee to process the home loan request of borrowers. Even if the loan request is rejected, the borrower cannot claim any refund of this amount. If any payments have been made through a cheque to the bank and this cheque bounces, the borrower will be made to pay a penalty.

Technical/legal assessment fee for property

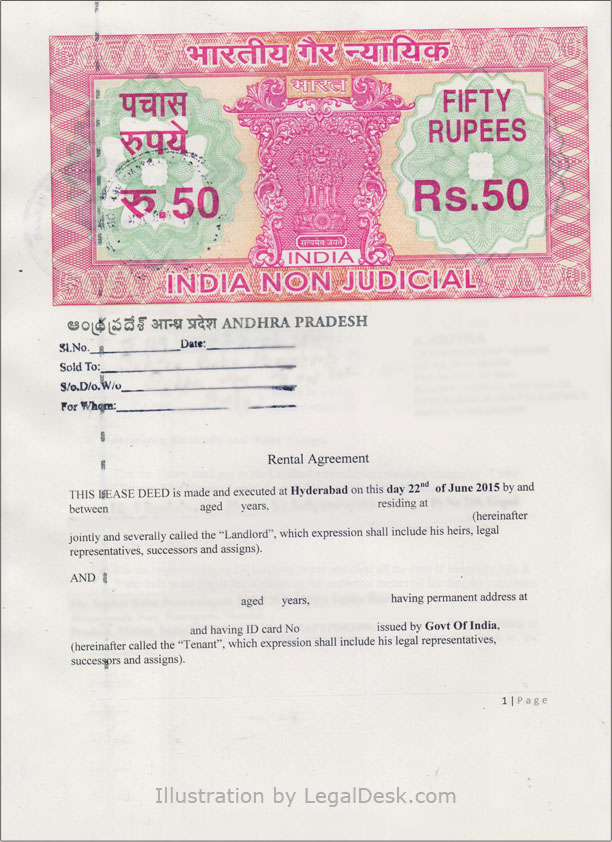

In India, the state government is in charge of establishing regulations and norms + overseeing the collection process. The tax levied is usually set at a percentage of the total transaction value. Stamp Duty is a significant fee that must be paid when transferring property title in legal documents. The payment of stamp duty functions as proof of record in cases of property disputes under the Indian Stamps Act, 1899.

Earlier, the agreement/intimation relating to mortgage by the way of deposit of title deed was out of the public domain. Transfer Onliine is payable by the person acquiring the property, within six months of the date of acquisition. Without stamp duty and property registration, you will not possess the right to secure your property from any frauds. Nature of the Property– Stamp duty rates for residential properties are frequently lower than those for commercial buildings. Commercial properties are subject to a higher stamp duty fee than residential properties since they typically need a lot more amenities.

Stamp duty, transfer duty and registration charges in Telangana

It is done to ascertain that bank is not over lending because in case of default, bank can recover their dues only by auctioning the property e.g. If property valuation is 1 Cr and bank approve loan of 1.2 Cr. In this case bank cannot recover the dues in case of default. Banks like SBI don’t have in-house lawyers to validate legal status of the property. The fees of these lawyers is being recovered from customers under the head Legal Fees. If all properties are situated within the same jurisdiction, then a single notice containing information of all properties and their title deeds is sufficient.

One annual account statement is free but in case you misplace or don’t receive & request another statement from bank then bank might charge upto Rs 500 per statement. Legodesk is not a law firm and does not provide legal advice. The use of any materials or services or software is not a substitute for legal advice. Only a legal practitioner can provide legal advice and a legal practitioner should be consulted for any legal advice or matter. We neither endorse, nor solicit the work of any Lawyers, Law Firms, and Legal Professionals. The pledged property is endorsed at the Sub-Registrar office.

Home loan administration fee

Registration charges in Telangana – – 0.5% subject to min. Registration charges in Telangana – 0.5% subject to min. The documents to be presented at the sub-office of the Registrar to register Telangana stamp duty are listed below. But keep in mind that the registrar may ask you to get more documents as per the situation. At HDFC, ‘fees on account of external opinion from advocates/technical valuers, as the case may be, is payable on an actual basis as applicable to a given case.

The location of the sub-registrar office will be communicated through SMS once a slot is booked by online payment or by depositing challans on SBI. With the implementation of Dharani by the TRS government on September 8, 2020, all land registration operations in Telangana were placed on hold. The loan processing fee is also called a loan origination fee. This charge is levied by the bank for processing your loan application. It is a one-time charge based on the percentage of the loan amount you applied for. The most common among all Home Loan Hidden Charges is Conversion fees.

For instance, a property located in an urban region will be subject to a higher stamp duty rate than a property placed in a rural or suburban location. The age of the property’s owner – Older people may receive a rebate on stamp duty. Many states provide senior citizens with discounted stamp duty fees. This is why an important factor in determining the stamp duty assessed on a given property is the age of the property owner. Document – A general power of attorney allows an agent or others to sell, transfer, or develop real estate.

It is essentially an undertaking given by you that you are depositing the title documents of the property with the bank at your own free will in return for a loan. For some banks, apart from the loan agreement, the undertaking needs to be registered and the government levies a stamp duty towards registration charges. Stamp duty charges vary from one state to the other, but on average, charges of 0.1 percent to 0.2 percent of the home loan amount apply.

After paying the applicable stamp duty, it’s time you pay registration charges so that the property is registered under the Registration Act, 1908. The registration charges are over and above the stamp duty. Mostly, these charges account for 1% of the market value or agreement value of the property.

The information provided online is updated, and no physical visit is required.

You would need to pay interest along with the EMI for the late payment. Home loans are a breather for many to fulfill their dream of owning a home. Getting 75% to 80% of the funds of the property cost from the bank makes you go further closer to your dream. You might be thinking that you only need to pay the fixed EMI to make your dream home come true.

The Dharani portal was supposed to include a portal for registering non-agricultural lands. The purchase or transaction cannot be acknowledged or received as evidence if stamp duty is not paid. In short – it is invalid, and such transactions will be seized by the law, along with a penalty. Note that paying a processing fee does not guarantee that your loan application will be approved. Since this charge is non-refundable, the borrower will not be able to claim any refund, if the lender rejects the home loan application. The payment can be made at the property registrar office.

Telangana’s government has set stamp duty at 4% of the property’s current market value. In addition, the new buyer will be required to pay a registration fee of 0.5% of the property’s value and a transfer duty of 1.5% of the property’s worth. Telangana’s state government sets the stamp duty, registration fees, and transfer duty rates. Telangana’s administration recently updated the state’s stamp duty levies, raising them by 1.5%.

Stamp duty, registration charges, the downpayment sum and processing fee are some of the expenses that are not funded by home loans. So, you should plan your home purchase sooner than later. Keep an eye on stamp duty and registration charges as they can change from time to time. Have a rough estimate of the amount you are likely to pay towards these expenses and accumulate your savings accordingly. Once you accumulate such a surplus, you should look to figure out the property that can come to your budget.

Comments

Post a Comment